how to pay indiana state taxes quarterly

Sign up Once logged-in go to the Summary tab and. Know when I will receive my tax refund.

Dor Ready To Pay Your Quarterly Estimated Taxes Intime Can Help

Cookies are required to use this site.

. Your browser appears to have cookies disabled. File a preprinted estimated tax voucher offered by the Indiana Department of Revenue DOR. We last updated the Estimated.

The Indiana income tax rate is set to 323 percent. Be sure to denote that you are making an individual income. However some counties within Indiana have an additional tax rate making the.

Some states also require estimated quarterly taxes. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Wheres My Income Tax Refund.

If youre self-employed you need to pay federal estimated quarterly taxes for the income you make. Access INTIME at intimedoringov In the top right corner click on New to INTIME. Enter this amount on line 4 Estimated Tax Installment Payment at the top of the form.

SBAgovs Business Licenses and Permits Search Tool. Line I This is your estimated tax installment payment. Personal Income Tax Payment.

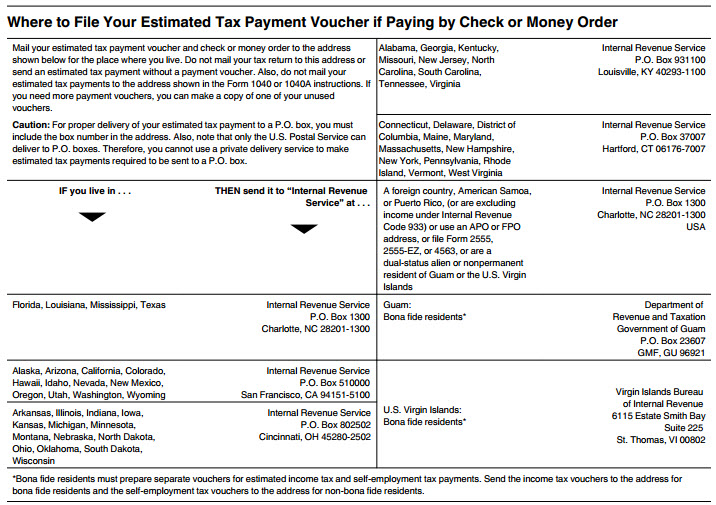

The amount of your standard deduction depends on your filing status. How to Pay Quarterly Taxes Estimated payments can be made by one of the following methods. DState D EZIP Code E FIndiana County F HTax Year Ending H Month Year.

Property TaxRent Rebate Status. The estimated income tax payment and Form E-6 and IT-6 are due on April 20 June 20 Sept. Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable.

Review your payment and select Submit. Indiana Small Business Development Center. Estimated payments may also be made online through Indianas INTIME website.

To make a payment via INTIME. Under non-bill payments click your payment method of choice. You can send us a check or money order through.

Choose the amount you want to pay and your payment method and select Next. For 2022 those figures are. Follow the instructions to make a payment.

Bank or credit card. Lines J K and L If you are paying only the. This means you may need to make.

Find Indiana tax forms. Department of Administration - Procurement Division. Any employees will also need to pay state income tax.

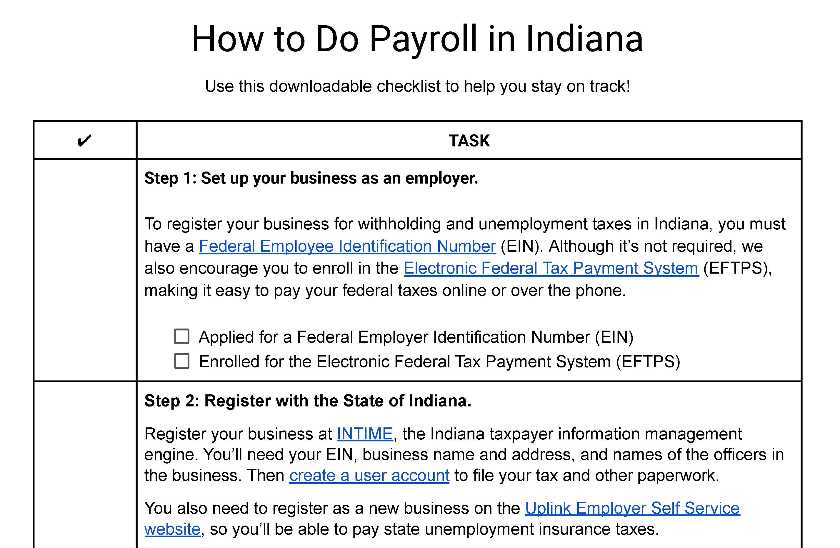

How To Do Payroll In Indiana What Every Employer Needs To Know

Quarterly Tax Calculator Calculate Estimated Taxes

How To Pay Sales Tax For Small Business 6 Step Guide Chart

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

Quarterly Tax Calculator Calculate Estimated Taxes

Local Income Taxes In 2019 Local Income Tax City County Level

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back

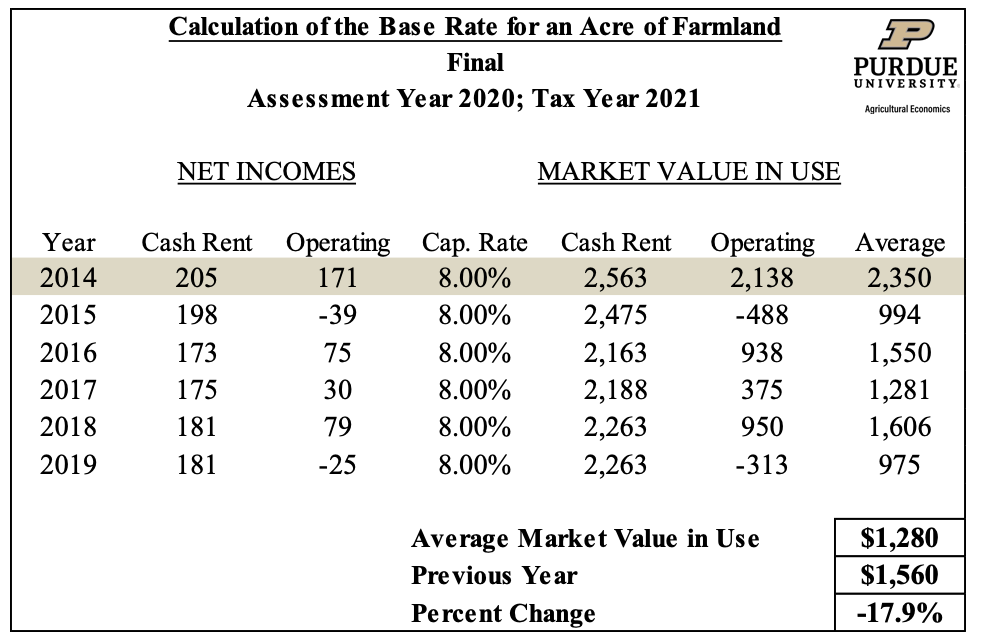

Farmland Assessments Tax Bills Purdue Agricultural Economics

Estimated Tax Payment Due Dates For 2022 Kiplinger

How To Pay Quarterly Income Tax 14 Steps With Pictures

How To File And Pay Sales Tax In Indiana Taxvalet

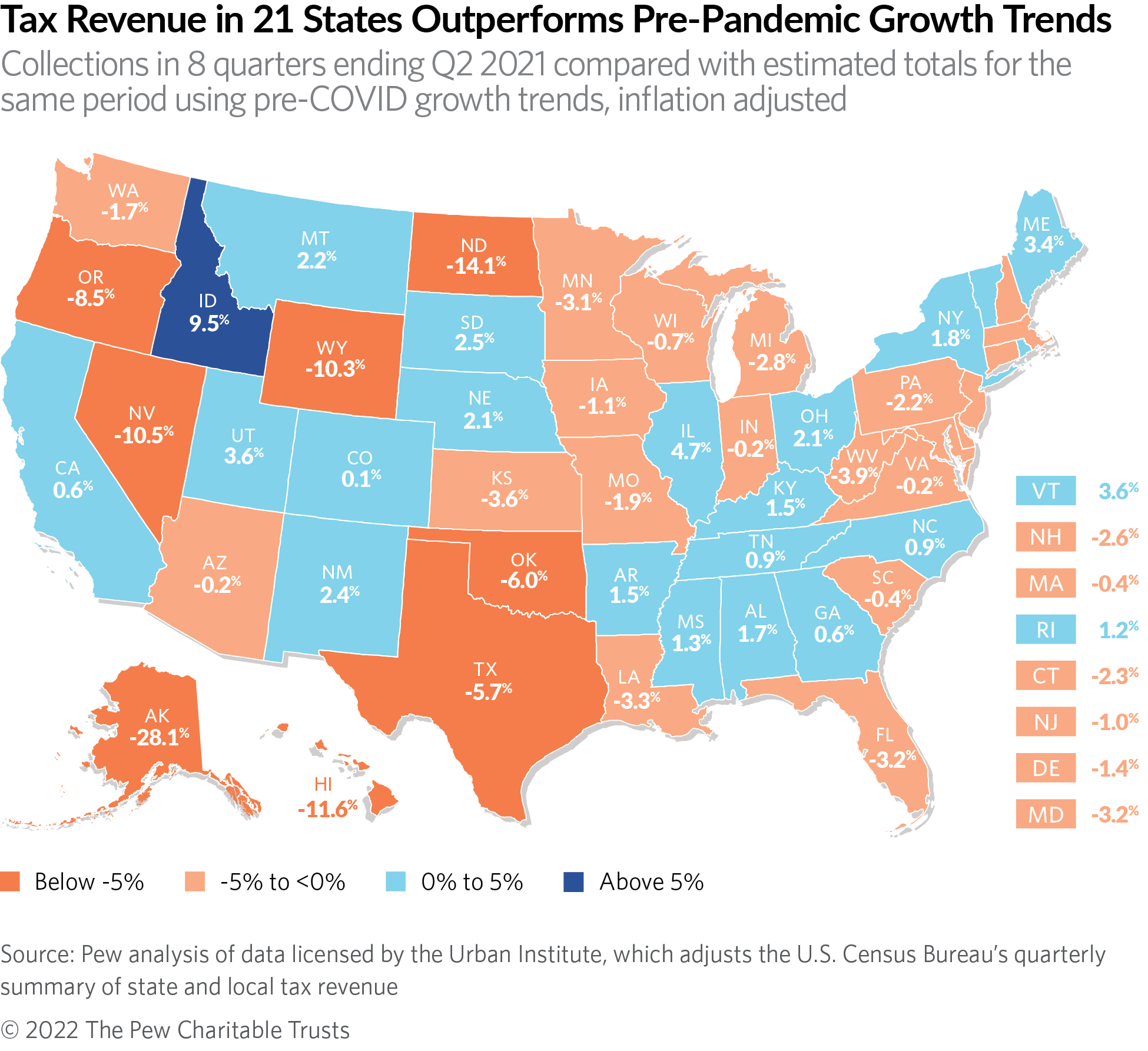

Tax Revenue In 21 States Outperformed Pre Pandemic Growth The Pew Charitable Trusts

A Complete Guide To Indiana Payroll Taxes

How To Pay Quarterly Income Tax 14 Steps With Pictures

Estimated Tax Payment Deadlines Have Changed But You Still Have Calculation Options Don T Mess With Taxes

How To Pay Quarterly Income Tax 14 Steps With Pictures

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Indiana State Tax Updates Withum

How To Calculate And Pay Quarterly Estimated Taxes Young Adult Money